Andra Arnold & Associates are a Top Rated, Award-Winning Guelph real estate team that has a passion for helping people. We truly live by our motto “Here to Help”. Our team brings quality expertise to our clients’ buying and selling experiences. The team's dedication, eagerness to help, and experience allow clients navigate one of life’s biggest decisions!

Everything You Need to Know About Real Estate Cap Rate (Updated in 2024)

Many successful real estate investors use cap rates to make informed property decisions. Knowing what makes a good cap rate can help you build a strong investment portfolio.

Keep reading to learn what a real estate cap rate is, how it works, examples, and why it’s important.

What is the Cap Rate in Real Estate?

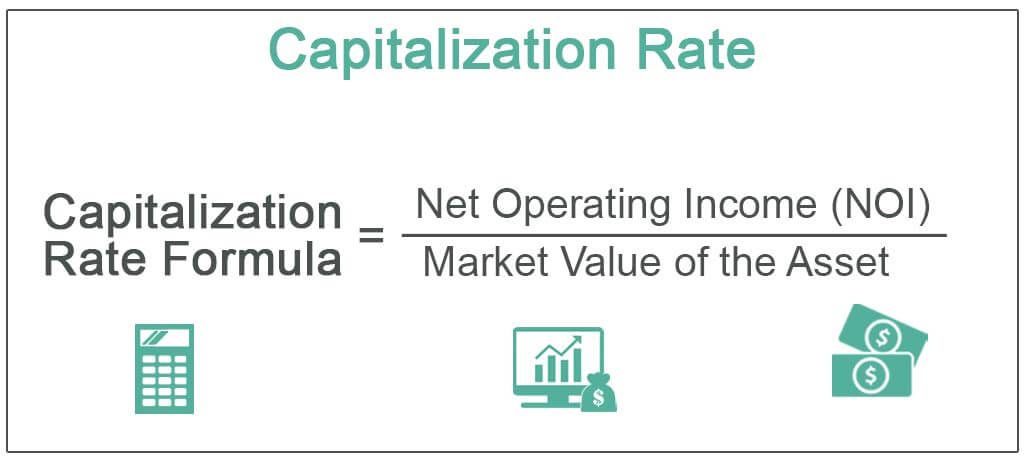

The capitalization rate (cap rate) is a financial metric that determines how profitable an investment property can be, assuming the buyer purchases the property with cash and not financing. A higher cap rate indicates a higher potential return but may also have higher risk. A lower cap rate suggests lower risk but potentially lower returns.

How to Calculate Cap Rate in Real Estate?

You can calculate a residential property's real estate cap rate by determining the net operating income (NOI) and dividing it by the property's purchase price.

Let’s say you purchase a rental house for $300,000. The house generates a rental income of $24,000 annually and has operating expenses totalling $6,000 annually, including property taxes, insurance, and maintenance costs.

To calculate the cap rate, subtract the operating expenses from the rental income to find the NOI, which is $24,000 - $6,000 = $18,000. Divide the NOI of $18,000 by the purchase price of $300,000 to find the cap rate. This gives you a cap rate of 6%.

What is a Cap Rate Example?

In the following example, the cap rate for the residential property investment is 6%. It shows the expected annual return on investment based on the property's rental income and purchase price. Here is the calculation breakdown:

Purchase price: $300,000

Property income: $24,000

Property expenses: $6,000

NOI: $24,000 - $6,000 = $18,000

Cap rate: $18,000 / $300,000 = 0.06

0.06 x 100 = 6%

Why is a Cap Rate Important?

The cap rate is important because it helps investors understand how much income they can earn from a property compared to its purchase price. Investors and landlords can use cap rates when evaluating different property types, including:

- Single-family rental homes

- Multifamily rental properties

- Rentable townhouses

- Apartment buildings

- Commercial real estate

It can also assess:

- Investment potential: Investors can compare different properties' cap rates to determine which offers the best ROI.

- Risk: A lower cap rate may indicate less risk, while a higher one may suggest more risk.

Market conditions: In a competitive market with high demand for properties, cap rates may be lower, while in a less competitive market, they may be higher.

Historical Cap Rate Trends

Several factors can affect cap rates across various real estate markets and property types. Economic conditions, including interest rates, inflation, and overall economic growth, significantly influence investment decisions and impact cap rates.

Changes in market demand can contribute to fluctuations in cap rates, with strong demand leading to lower rates and oversupply resulting in higher rates — the type of property, whether residential or commercial, also influences cap rate variations.

Geographic location is another factor, with prime locations typically having lower cap rates due to higher demand. Investor preferences and risk tolerance levels can further shape cap rate trends, with investors wanting higher returns during uncertain economic times and showing acceptance of lower rates in stable market conditions.

Cap Rate Compression

Cap rate compression refers to the decrease in capitalization rates, which investors use to evaluate the return on investment. This phenomenon is characterized by declining rates relative to property values. Several factors contribute to cap rate compression, such as:

- Increased demand: As more investors buy up real estate assets for their stable returns, competition intensifies, pushing prices higher and lowering cap rates.

- Low-interest rates: When rates are low, investors typically accept lower yields on their investments.

- Economic growth: Strong economic conditions can increase property income, reducing cap rates because real estate investors see less risk.

Limited supply: Limited supply can drive up property values and compress cap rates in areas with restricted development.

Cap Rate Compression Effects on the Real Estate Market

Cap rate compression often increases property values, as investors are typically willing to pay higher prices for properties generating the same income stream. However, this can lead to lower yields on real estate investments, potentially affecting overall portfolio returns.

Lower cap rates may indicate reduced risk but expose investors to greater vulnerability to future market fluctuations. Cap rate compression presents a complex area for real estate investors, balancing higher property values against diminished yields and heightened risk perception.

To navigate this environment, investors can use the following strategies:

- Diversify: Spread investments across different property types, locations, and risk profiles to reduce exposure to any asset or market.

- Value-add opportunities: Look for properties with potential for improvement or repositioning to enhance income and offset lower initial yields.

- Active management: Implement strategies to increase property income, such as reducing expenses, increasing rents, or leasing vacant space.

- Long-term perspective: Focus on investments with stable cash flows and strong principles to withstand market fluctuations over time.

- Risk assessment: Do your due diligence and assess an investment's potential risks and rewards to make informed decisions.

During the early 2000s, as real estate prices soared to historic highs, cap rates reached new lows, marking a significant occurrence in the market. Cap rates, previously in the 8-10% range, plummeted to 5-7% by 2006. This dramatic decline was driven by a surge of capital flowing into the real estate sector, driving prices up and yields down.

The unusual compression of cap rates during this period highlighted the intense competition among investors and the growing demand for real estate assets, emphasizing the importance of monitoring cap rates as a critical indicator of market trends and investor outlook.

Thinking of Investing in Real Estate?

Understanding and using cap rates can help you make informed investment decisions and achieve your goals. While this valuable tool can evaluate the potential return on property investment, you should always pair it with expert advice.

Andra Arnold and Associates specialize in real estate investment and can guide you through the complexities of cap rates, ensuring you make the best choices for your portfolio.